For quite awhile after college, Nate and I operated without a household budget. If you had asked me about my monthly budget checklist at that point I would have said, “You mean the check I send to the credit card company every few weeks?”

Yeah. We were naive. We spent money like it was water. Three kids, a house and a couple of cars later…we eventually realized that we could make our money go really far. if only we could keep track of it.

Nowadays, I think of it like this: children who aren't told how to act can't be held accountable for misbehaving. Money is the same way. If it goes rogue and exits your account without explanation, chances are you simply haven't taught it what it's supposed to do.

Here's how we double-check our accounts every single month to keep our money in check.

There are hundreds of accessible guides to walk you through setting up an overall budget for the very first time. If you've never done this, it's easy. Write down your monthly income and review past bank statements to determine how much, on average, your family spends each month on every category from home goods to entertainment to groceries. Your goal is to start coming in under that amount. Over time, trim back areas that seem out-of-balance and invest the excess wisely.

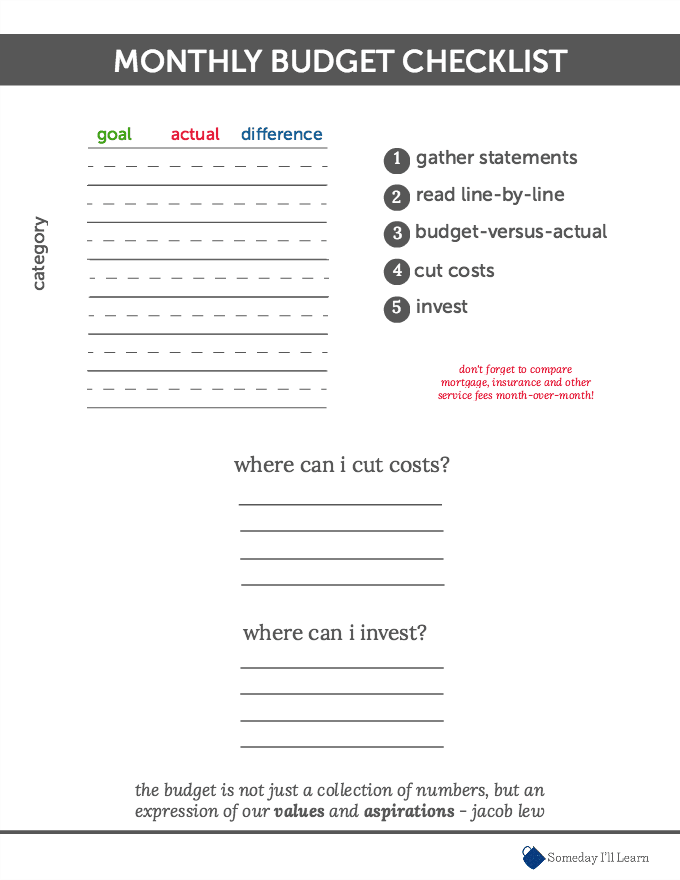

Now for the monthly budget checklist. That's what will keep you on-track, and astonishingly it is the part that most financial experts don't address! A budget doesn't matter if you don't circle back and interact with it. Without oversight, those dollars will go rogue. They'll start being drawn out by fees and subscriptions and even fraud. Just like children, you can't simply tell your dollars what to do and expect them to behave. You need to correct their actions repeatedly.

Monthly Budget Checklist

- Gather credit card and bank statements as well as your mortgage and loan information. We use an online budget tool to pull all our data into one convenient spot.

- Read through each and every line to see if anything looks unfamiliar. Are there new fees? Names you don't recognize? If so, look up the company and get to the bottom of it. Especially during high-volume months like the holidays, you may be the victim of identity theft. We have personally staved off several fraudulent charges by catching them early and reporting them to our bank, and we've even found reputable companies (such as our home insurance provider) suddenly increasing our fees without explanation. Nip it in the bud!

- Divide your monthly spending into categories and see how this month's actual spending stacks up against your budget goals. Do any areas seem out-of-whack? Again, dig deeper. Assess what issues are impacting your spending.

- Cull anything unnecessary. If you realize you went overboard on shopping, return what you don't need. Cancel subscriptions you may have signed up for without thinking through. Compile services to save money and minimize clutter in your monthly budget so things don't slip by unnoticed.

- Invest the excess. Determine which loans you should be paying down or what money markets, rentals, stocks or personal endeavors you want your money to grow into.

We also use a monitoring service to detect unusual activity on our accounts to make sure there aren't any credit lines being opened under our names or other suspicious activity. Especially during tax season, when many people steal account data right out of mail boxes in order to fraudulently collect tax refunds, we're being mindful of paperwork and keeping an extra-watchful eye over our information as we go through our monthly budget checklist.

Do you have a monthly budget checklist? How do you engage with it on a regular basis as spending and account concerns are in-flux?